Fair Value Gaps & Inversion Fair Value Gaps: A Trader’s Guide

Markets often look random, but beneath the chaos lies real structure. One of the clearest footprints price leaves behind is the Fair Value Gap (FVG), an imbalance created when momentum is so strong that buyers and sellers don’t fully meet. Learning how to spot and trade FVGs can give traders an edge in identifying high-probability setups.

But there’s another layer many traders overlook: Inversion Fair Value Gaps (IFVGs). These advanced patterns add precision by showing when a gap flips its role, becoming either support or resistance. In this blog, we’ll walk through what FVGs are, how to trade them, and how IFVGs can sharpen your strategy even further. Let’s get deeper into it!

What is a Fair Value Gap (FVG)?

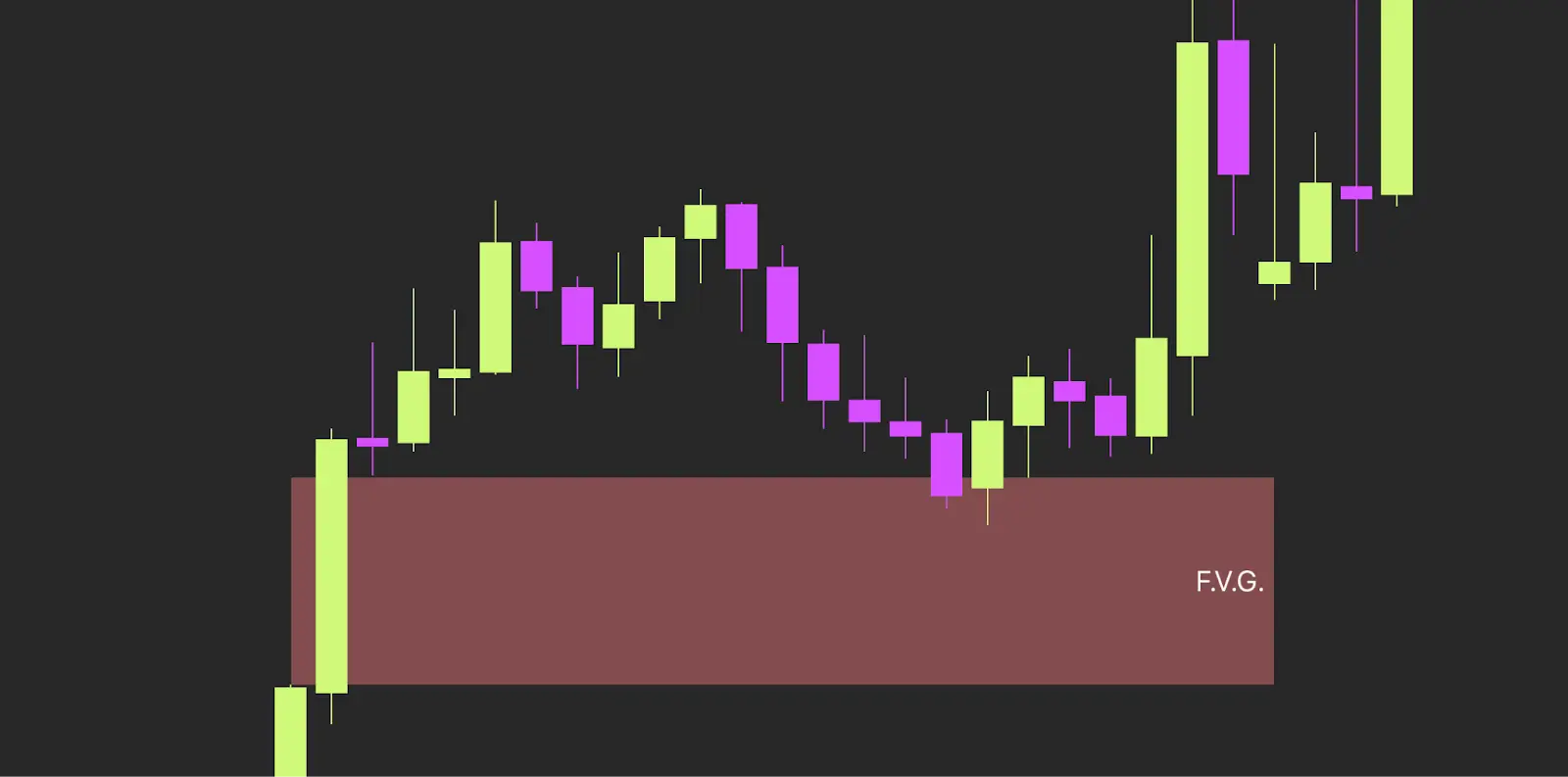

A Fair Value Gap happens when price moves so aggressively that it skips levels of balance. Typically, this forms with a three-candle sequence:

🔹 Candle 1 pushes strongly.

🔹 Candle 2 extends in the same direction, leaving a “gap” between its wick and Candle 1.

🔹 Candle 3 confirms the gap is left untested.

That gap represents inefficiency. Price didn’t give the market time to trade fairly on both sides. More often than not, price will revisit this area to “rebalance.”

Think of it like a staircase where one step is missing. At some point, the market comes back to fill it in.

Why FVGs Matter

FVGs highlight where institutions stepped in aggressively. These levels often:

🔹 Act as magnets for price to return to.

🔹 Provide high-probability entry zones when aligned with structure.

🔹 Combine well with other Smart Money Concepts like Break of Structure (BOS), liquidity grabs, and order blocks.

Instead of chasing random moves, FVGs give you context for where price is likely to trade next.

How to Trade FVGs

- Identify: Look for strong impulsive moves that leave a clear gap.

- Confirm: Use higher timeframe (HTF) structure to ensure you’re trading in the right direction.

- Refine: Drop to lower timeframes (LTF) to pinpoint exact entries.

- Execute: Enter when price retraces into the FVG, with stops beyond the gap.

- Manage risk: Of course not every gap will hold, so proper risk control is key.

Example: If EURUSD breaks structure upward and leaves a bullish FVG, wait for price to retrace into the gap before entering long, aiming for continuation higher. This way you can use FVG’s as both an entry model and as an extra confluence to your existing model.

Inversion Fair Value Gaps (IFVGs)

For the advanced traders who want to dive a bit deeper: Inversion Fair Value Gaps. Here’s where things get interesting. Sometimes, when an FVG gets traded through, it doesn’t just disappear: it flips its role. That’s an Inversion Fair Value Gap for you.

For example:

🔹 A bullish FVG forms, price retraces and fills it, but instead of continuing up, the level acts as resistance and price sells off.

🔹 The same works in reverse for bearish FVGs flipping into support.

Why is this powerful? Because IFVGs signal strong institutional activity. They show that the market isn’t just rebalancing. It's using that level as a turning point.

Think of it like a door that swings shut behind you. Once it closes, it locks, and you can’t go back the same way.

Common Mistakes

🔹 Treating every FVG as tradable → many get ignored.

🔹 Ignoring the bigger picture → FVGs must align with HTF structure.

🔹 Overleveraging just because an FVG looks “clean.”

🔹 Forgetting to track how gaps invert into IFVGs for added confluence.

What This Means for Hydra Traders

FVGs and IFVGs aren’t magic bullets, but they’re one of the most consistent tools for spotting imbalance and confluence in the markets. Traders funded with Hydra use concepts like these to refine entries, improve risk-to-reward, and stay disciplined.

Whether you’re trading via Instant Funding or working through Challenges, mastering FVGs can make the difference between random entries and a structured trading approach that leads to payouts.

Conclusion

Fair Value Gaps show inefficiency. Inversion Fair Value Gaps show power. Together, they reveal where the market is likely to move next and how institutions are really operating.

If you’re serious about trading with precision, FVGs and IFVGs deserve a place in your playbook.

⚡ Ready to put your edge into action? Explore Hydra Funding’s programs today and trade capital your strategy deserves.